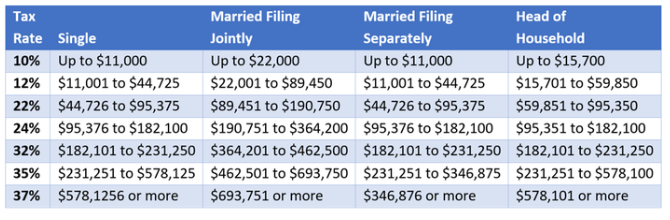

For the years 2023 and 2024, there are seven federal income tax rates ranging from 10% to 37%. Your filing status and taxable income determine the tax brackets and rates that apply to you. These adjustments ensure that the increasing cost of living does not force taxpayers into a higher tax bracket. Furthermore, these adjustments can lower taxes for those whose income has not kept up with inflation.

How do income tax brackets work?

The tax system in the United States is designed to be progressive, which means that it determines the amount of tax you owe by dividing your taxable income into different sections, or tax brackets, each with its own corresponding tax rate. This progressive system ensures that individuals with higher incomes are subject to higher federal income tax rates, while those with lower incomes are subject to lower rates. This system has one advantage: It will not tax you at the highest rate on your entire income, regardless of which tax bracket you fall into.

The tax code incorporates various measures, such as adjusting income thresholds, on an annual basis to account for inflation. The indexing strategy implemented to safeguard taxpayers from being inadvertently pushed into higher tax brackets due to inflation is a phenomenon commonly referred to as “bracket creep.”

What is the marginal tax rate?

The marginal tax rate pertains to the proportion of tax that an individual is obligated to pay on the remaining portion of their taxable income. This is typically equivalent to the highest tax bracket that you fall into.

To illustrate, let’s consider a scenario where you are a single filer in the year 2023 and your taxable income amounts to $45,000. In this case, you would be in the 12% tax bracket. If your taxable income increases by $1, you would also have to pay 12% tax on that additional dollar.

Ways to shift to a lower tax bracket and lower your federal income tax rate

Two common methods used to lower your tax bill are credits and deductions. Tax credits have the advantage of directly reducing your tax bill by the same amount. They do not impact the tax bracket you fall into. On the other hand, tax deductions work by reducing the portion of your income that is subject to taxes. Typically, deductions lower your taxable income based on the percentage of your highest federal income tax bracket. For instance, if you are in the 22% tax bracket, a $1,000 deduction could potentially save you $220.

To put it simply, it is beneficial to take advantage of all available tax deductions as they can lower your taxable income and potentially move you into a lower tax bracket. This results in paying a lower tax rate.

For the years 2023 and 2024, there are seven federal income tax rates ranging from 10% to 37%. Your filing status and taxable income determine the tax brackets and rates that apply to you. These adjustments ensure that the cost of living increases do not force taxpayers into a higher tax bracket. Furthermore, these adjustments can lower taxes for those whose income has not kept up with inflation.

How do income tax brackets work?

The tax system in the United States is designed to be progressive; it determines the amount of tax owed by dividing taxable income into different sections, or tax brackets, each with its own corresponding tax rate. This progressive system ensures that individuals with higher incomes are subject to higher federal income tax rates, while those with lower incomes are subject to lower rates. The system has one advantage: It will not tax you at the highest rate on your entire income, regardless of which tax bracket you fall into.

The tax code incorporates various measures, such as adjusting income thresholds, on an annual basis to account for inflation. This indexing strategy is implemented to safeguard taxpayers from being inadvertently pushed into higher tax brackets due to inflation, a phenomenon commonly referred to as “bracket creep.”

What is the marginal tax rate?

The marginal tax rate refers to the percentage of tax that you pay on the final portion of your taxable income. This is typically equivalent to the highest tax bracket that you fall into.

In the year 2023, if you are a single filer with a taxable income of $45,000, let’s consider this scenario to illustrate. In this case, you would be in the 12% tax bracket. If $1 were added to your taxable income, you would consequently have to pay a 12% tax on that additional dollar.

Ways to shift to a lower tax bracket and lower your federal income tax rate

You frequently employ credits and deductions to lower the overall tax amount you are required to pay. Tax credits have the advantage of directly reducing your tax bill by the same amount. They do not impact the tax bracket you fall into. On the other hand, tax deductions work by reducing the portion of your income that is subject to taxes. Typically, deductions lower your taxable income based on the percentage of your highest federal income tax bracket. For instance, if you are in the 22% tax bracket, a $1,000 deduction could potentially save you $220.

To put it simply, it is beneficial to take advantage of all available tax deductions as they can lower your taxable income and potentially move you into a lower tax bracket. This results in paying a lower tax rate.

If you have any questions or need help with your tax return or tax planning. Give us a call at 256-489-1478 or book an appointment here.