-

REFUND STATUTE EXPIRING

REFUND STATUTE EXPIRING: DON’T MISS OUT! If you have not filed your 2018 tax return and have a refund coming, time to claim that refund is running out! The IRS estimates that more than 1.35 million taxpayers have not filed their 2018 tax returns with approximately $1.3 billion of unclaimed refunds available for…

-

Accounting for Restaurants

ACCOUNTING FOR RESTAURANTS Operating a restaurant is a dream for many, but there is a lot more to it than meets the eye. There are far more restaurants that fail than succeed, and that’s frequently because entrepreneurs spend more time focusing the daily operations of the business rather than on the accounting and tax…

-

Don’t Just Sit There! Start Getting More Tax Refund Now!

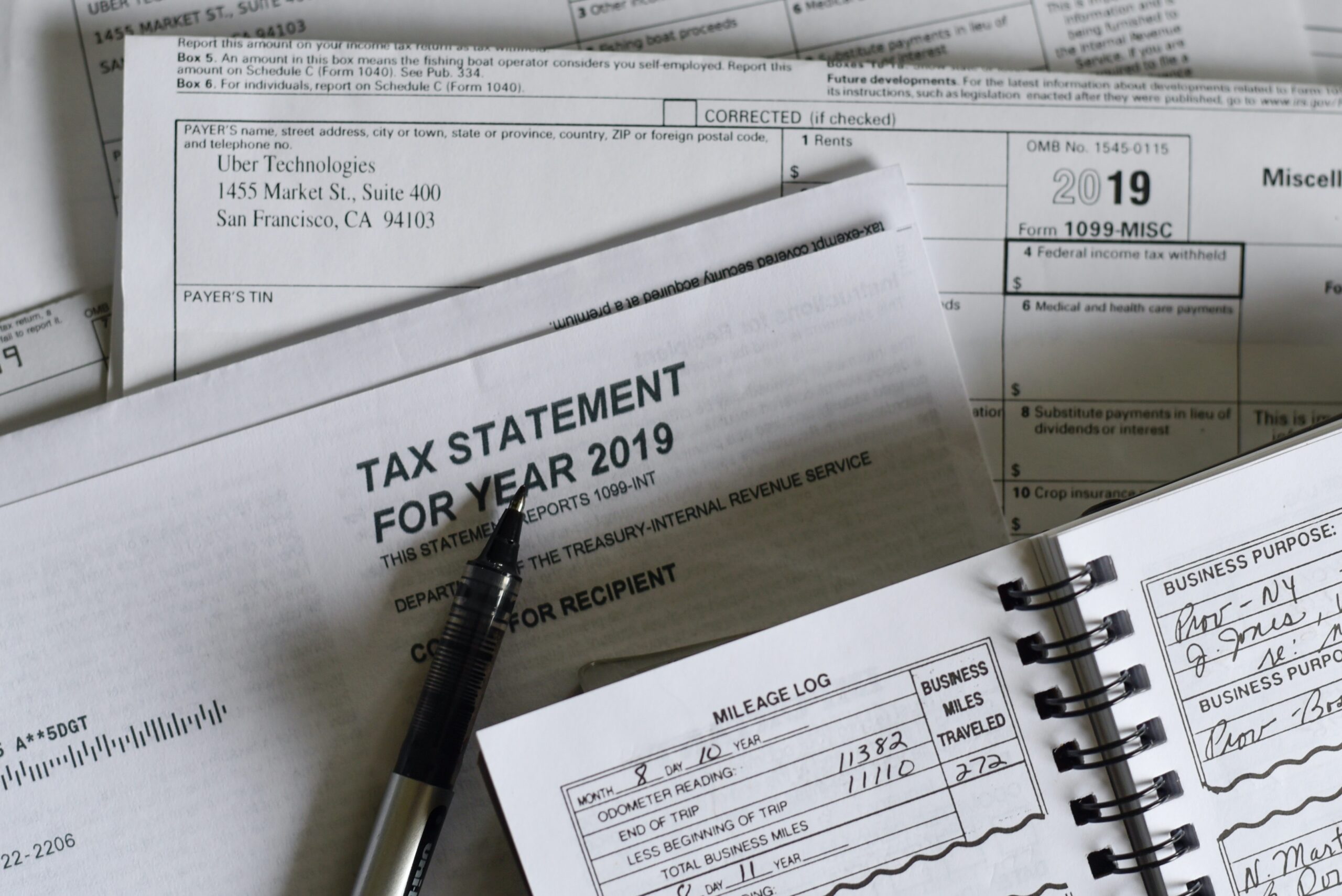

Don’t Just Sit There! Start Getting More Tax Refund Now! You are home for an undetermined amount of time. Use it to gather your tax receipts and deductibles for more return on your tax refund. On average, Americans will spend 7 hours a year assembling, organizing, and planning for their tax return. Many…

-

Divorce or Separation May Have an Effect On Taxes

Divorce or Separation May Have an Effect On Taxes Taxpayers should be aware of tax law changes related to alimony and separation payments. These payments are made after a divorce or separation. The Tax Cuts and Jobs Act changed the rules around them, which will affect certain taxpayers when they file their 2019 tax returns…

-

Taxpayer Withholding

The Internal Revenue Service warned taxpayers to check their income tax withholding for almost all of 2018 due to how the Tax Cuts and Jobs Act affected tax brackets. The IRS announced it would waive the penalty for not paying enough estimated tax if affected taxpayers met most of their tax liability in 2018.

-

Eco-friendly Cars – Save On Taxes

Tax Write Offs for Eco-friendly Vehicles Save up to $7,500 on your next vehicle–if it’s eco-friendly? Have you thought about an electric or plug-in hybrid car? If so, you could save! Not to mention the savings on fuel at the pump by using an electric vehicle. Most business owners are aware they can write…