What You Should Know About Filing A 1099-MISC Form

If you recieve payments as a trade or business from other people or entities, that payment amount is reported to you and the IRS if they total a certain amount for the given tax year. Not all 1099 forms are the same. 1099-MISC is a miscellaneous form which includes any freelance work or contract labor done by the taxpayer for another business. This form includes personal information such as name, address, SSN, or even employer ID. Additionally, it will classify each individual payment in seperate catagories on the form. If you are incorporated as a limited liability company (LLC), you will recieve this form for filing. C corporations or S corporations will not.

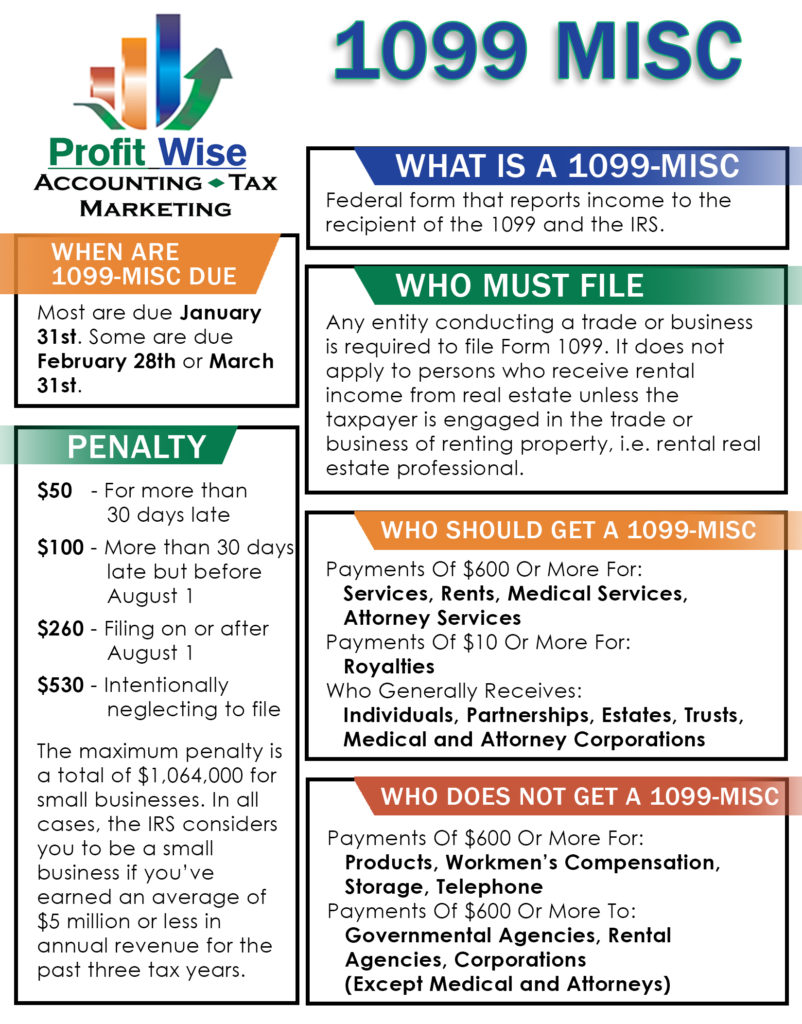

Below we have provided an informative graphic for business owners explaining what a 1099-Misc Form is. This info graph also explains when the form should be filed and the penalties for not doing so.

Business owners please be aware! You may not even realize that your’re dealing with a side business that needs a 1099-Misc. Double check today!

Takeaway

If you have a trade or business and need to file an 1099-MISC, we can help! Need some advice? Call us today! 256.489.1478 or schedule an appointment below.