-

Spend Management Principles and Strategies

One of the most important aspects of running a successful business is managing the money that comes in and goes out. That’s where spend management comes in. Spend management refers to the process of controlling and optimizing costs across all aspects of a business, from procurement and supplier relationships to employee expenses and more. In…

-

Things To Do If A Recession Happens

Amidst the current economic state, characterized by the highest inflation rate in a decade and concerns of a prolonged recession, corporate CEOs are engaging in discussions regarding the potential occurrence of a recession. Typically defined as an economic downturn lasting at least six months, a recession is a matter of significant consideration for business leaders.…

-

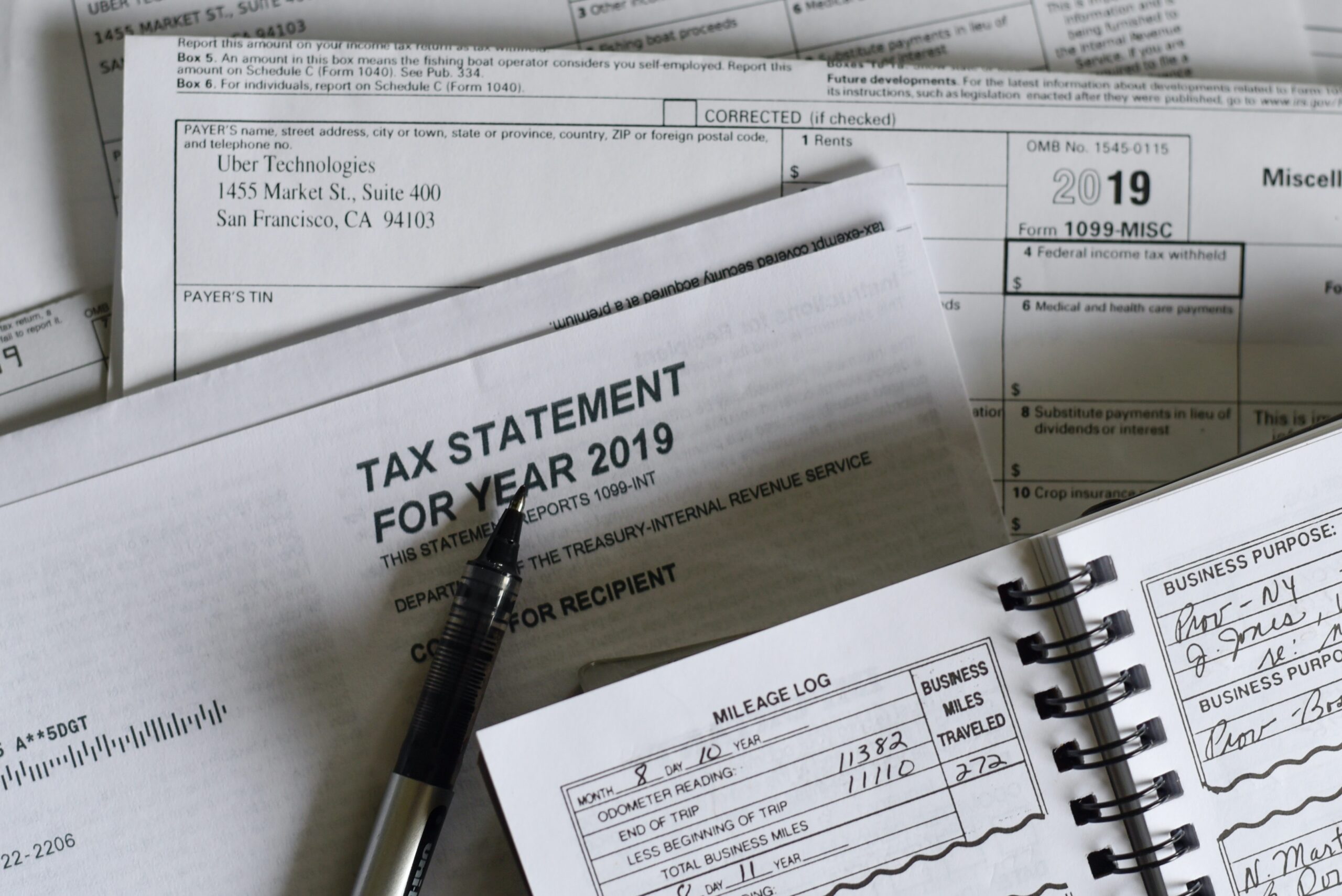

The Basics of Maximizing Your Tax Savings

It is crucial to plan for taxes as a part of business and personal financial management. It involves making strategic decisions and taking advantage of available opportunities to minimize tax liability while remaining compliant with tax laws. Investing in growth and achieving financial goals can be made easier with effective tax planning, which can lead…

-

Avoid Estate Tax

A Tip on passing down your vacation home: Establish a Family Limited Partnership Family Limited Partnerships are powerful estate planning tools that enable the smooth and tax-efficient transfer of business ownership from one generation to the next. If you own a vacation home you want your children to own after you’re gone, you…

-

Unpaid Federal Debt? Don’t Lose Your Passport

DON’T LOSE YOUR PASSPORT BECAUSE OF UNPAID FEDERAL DEBT The IRS has begun issuing notice CP508C to taxpayers with “seriously delinquent” tax debt and the service has resumed its program of notifying the State Department of taxpayers’ unpaid federal debts. The U.S. Department of State generally will not renew a passport or issue a new passport…

-

REFUND STATUTE EXPIRING

REFUND STATUTE EXPIRING: DON’T MISS OUT! If you have not filed your 2018 tax return and have a refund coming, time to claim that refund is running out! The IRS estimates that more than 1.35 million taxpayers have not filed their 2018 tax returns with approximately $1.3 billion of unclaimed refunds available for…

-

Accounting for Restaurants

ACCOUNTING FOR RESTAURANTS Operating a restaurant is a dream for many, but there is a lot more to it than meets the eye. There are far more restaurants that fail than succeed, and that’s frequently because entrepreneurs spend more time focusing the daily operations of the business rather than on the accounting and tax…

-

Working Out of State

Employees Working out of state Some employees are still working at home and will keep doing so in the future. If you have employees working out of state, this can create additional tax and payroll challenges. State income tax withholding for employees When it comes to payroll tax withholding, state withholdings primarily follows…